I know this is going to be an interesting one. We all want to know the answer to this question that when will market correction end? Well, nobody can predict the market. But let’s try to analyze the current market situation to check when will this correction ends.

To get the answer to this question, we first need to know what is the market correction? When the market goes up then there will be a downtrend in the market. Same way, when the market is going down, there will be a bounce back. This changing trend is known as the market correction. But when will this correction ends nobody knows.

So today I am going to tell you a trick which will tell you when the correction will end. You don’t need any tool for that, no technical or fundamental analysis is required to check the correction.

Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it. – Peter Lynch

First, let’s understand why there is a correction in the market? When the market moves upward, it becomes heavy. Means there are many weak investors entered who doesn’t have their own views and lacking knowledge. They just want to ride the flow of the market. So market throws them out periodically. Let’s assume there is an uptrend right now and we are at the peak of the uptrend. Now at this top level, there are many people who have jumped in to just ride the flow without any conviction or knowledge. They want to take advantage of momentum. So the market will correct to throw these people out of the market. This phenomenon is called a correction.

So in a simple language, correction is correcting the current trend whether it’s bullish or bearish. This correction will come to throw out weak traders out of the market.

Now how to find when will this correction starts or ends? Well, there are many technical indicators which can tell you the future market trend. But we are not going to discuss them today. I will tell you something through you will find yourself whether the correction end or not? It requires a simple common sense.

The 3 “FUL” of market participants

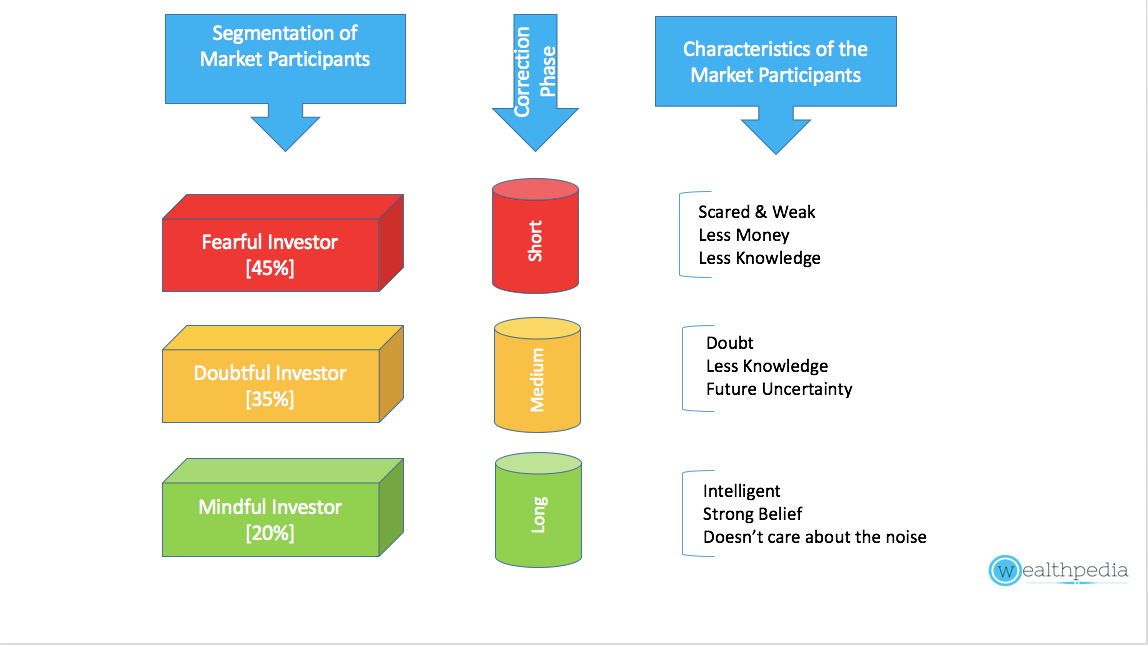

Let’s understand what type of people are participating in the market. There is mainly two type of the participants, bullish and bearish. Under each type, there are three types of “FUL” investors. They are fearFUL, doubtFUL and mindFUL.

fearFUL = Market participants who are always scared of the market. Scared and weak investor/trader. Doesn’t have much money and knowledge. These are the rats who run first when they think the ship is sinking.

doubtFUL = Participants who are always in doubt, they usually take long positions but have their own doubts about the market direction. These people have inadequate knowledge. They always carry doubt about the future of the market.

mindFUL = These type of participants are intelligent people who know and believes that the current market trend will surely reverse in the future. They have special analysis and study about the market trends and future predictions. They don’t care about the short-term market trends.

So what do you learn from the above segmentation of market participants? As I mentioned earlier, the market wants weak people to move out of the market. The corrections in the market will always happen to remove such participants from the market. The market wants people who have full conviction in the market.

Now let’s check when the market correction will end? To do so first we need to check the length of the market correction.

There are three types of the market correction. Short term, medium term, and long-term. Once we have an idea about the length of the correction we will check how this correction will end?

The fearFUL type of participants will be out in the short term of correction. They will exit the market in the short correction as their fear will make them exit from the market. To check whether these type of participants are all gone or not, you can check the F & O data where the market’s future positions are less. If there is not much of exposure, you can conclude that the short-term correction will end soon.

Short correction generally occurs to remove the future positions from the market. This will not impact the doubtful investors as they have invested through delivery and they have a doubt that market will bounce back any time. He also has adequate money to average his position in the market. In the year 2017, all corrections were of short-term.

DoubtFUL investors have taken their positions in the cash market so they can wait for the reversal trend of the market. This type of investors will exit the market when their doubts about the market direction are solved. They wait until their doubts are cleared. This type of correction usually persists for a period of 6 to 8 months or maybe longer.

The latest example of this correction is the time from Feb 2018 to till date. Check around you to confirm that this doubtFUL type of investors have exited the market or not. Check with your friends, family, colleagues etc. to confirm.

Most importantly ask your self that whether you should exit your positions at this point or not. If the answer is no then this medium type of correction is still not over. It will continue for some more time.

This type of correction will end when your doubt is confirmed that market will not move for next one or two years.

The market may reverse its trend before that as well, but if you feel that it not going to work for next two years and you exit your positions thinking that I will enter the market when its around 20% to 30% below of the today’s level. At this point, the correction is about to end.

As per my analysis, this correction is still not over. The biggies who have their positions in the market are still there and have not exited the market thinking that they will enter again at the lower level.

Why are they still not exiting the market? First, they have positions in cash market so they can afford to wait, time is not a constraint for them. Second, their purchase price is so high as compared to the current price, so they cannot afford to book lose at this stage. Third, they know the market will reverse its trend sooner or later.

The last one is a long correction. This type of correction usually lasts for years. It’s long in duration and big in price. The people who have in-depth knowledge of the market are started losing their patience and started exiting their positions.

Intelligent investors are also losing their patience and exiting the market. At this point, the long-term correction will over and trend reversal will start.

Take the example of pharma sector, it’s going through this long-term market correction. Of course, the fearFUL people have already booked their loses and exited long back. DoubtFUL people have also confirmed their doubts and booked losses and exited. The MindFUL investors are also lost their patience and started exiting the pharma sector.

This is the style of the market. It will step by step throw people out of the market. In the stock market, if you really want to make money you require conviction, patience, knowledge, analysis.

If you don’t have these things, the market will throw you out at any stage. Do your analysis, check the chart, study price trend, understand different technical parameters. And lastly, use this formula to confirm the correction trend.

The market wants you to exit your positions so very few people will have the stake and then it will bounce back. This is the ever going cycle of the market.

Let me know in which category you fall.