The famous messaging app WhatsApp is all set to launch its payments service in India in the name of WhatsApp Pay. It will be an easy in-app feature within the WhatsApp mobile app itself. Users will not have to download any separate mobile app to use the WhatsApp Pay payment feature. The payment feature will use UPI as a platform and Facebook’s existing infrastructure to provide a payment facility in India. In this article, I will take you through the WhatsApp Pay UPI Platform, its features, and benefits.

Being a messaging app with a user base of 400 million in India, the payment feature will surely be a game-changer. It runs on the UPI platform which is launched by the National Payments Corporation of India (NPCI). So to understand how WhatsApp Pay works, we need to first understand what is UPI and how it works?

What is the UPI Payment Platform?

Unified Payment Interface (UPI) is a brainchild by National Payments Corporation of India with support from the Reserve Bank of India and the Indian Banks Association (IBA). UPI is the real-time payment transfer system to enable users to transfer money instantly.

The transaction is very easy and fast that it can be done through a mobile phone through a single click with a UPI PIN. This way it is eliminating the need to have the account number, bank name and IFSC code to transfer the money. The main benefit of this system is it works round the clock 24X7 and 365 days.

How UPI is Different from NEFT/RTGS?

Let’s see some of the major differences between UPI and NEFT/RTGS payment options.

UPI Payments

- It transfers payment instantly

- Doesn’t require a bank account number

- Doesn’t require a bank IFSC code

- Works 24X7, 365 days

- Multiple accounts, one ID

- One-click, two-factor authentication

- Automated collection process

NEFT/RTGS Payments

- Money transfer requires around 30 minutes

- Requires bank account number

- Requires bank IFSC code

- Works only during the bank working hours

- One account, one ID

- Many clicks, two-factor authentication

- No such collection process

WhatsApp Pay UPI Platform

Now as you have understood what is UPI payment platform, Let’s now see the WhatsApp Pay UPI Platform. WhatsApp Pay has launched its beta testing program in February 2018. Since then around one million users have tested the payment service in India. The payment service will use two main infrastructure i.e. UPI platform and Facebook’s infrastructure. Facebook Messanger already has the feature for money transfer in the US. WhatsApp Pay will use this existing infrastructure of Facebook for WhatsApp Pay service.

So WhatsApp user transfers money through WhatsApp and the same will route through Facebook’s server and land to the UPI server. And that is where the problem started for the WhatsApp Pay launch in India. The Central bank has directed WhatsApp to set up a data center in India rather than in the US.

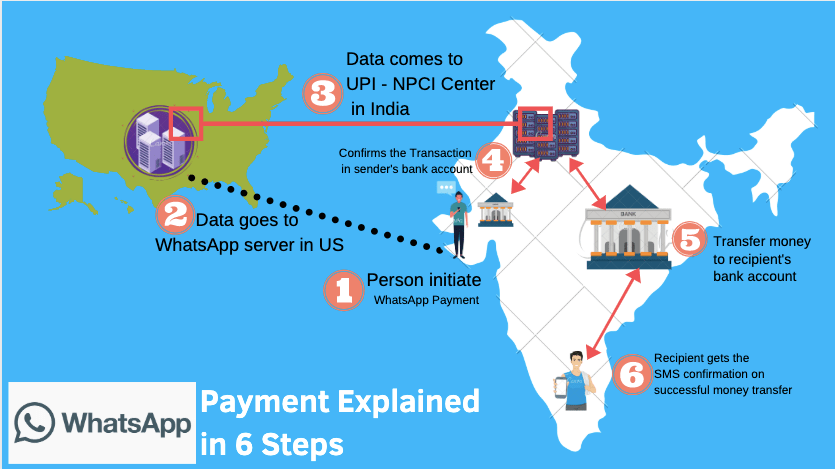

In the below image, I have explained the applicable steps for transferring money through WhatsApp Pay in India.

For example, Let’s assume a person A from Gujarat wants to transfer money to person B in Chennai. For that, person A will initiate the payment through the WhatsApp app. The payment transaction data will then go to WhatsApp’s server located in the US. From there the transaction will move to the UPI data center in India.

The NPCI server sends the data to person A’s bank to confirm the balance and UPI PIN. On the successful confirmation from the bank, the NPCI will transfer the money to person B’s bank account. Person B will then get the confirmation through the SMS from his bank that the money has been successfully transferred to his bank account.

Both people A and B will get the in-app confirmation on the successful transfer.

Reserve Bank of India has asked WhatsApp to establish the data center locally in India so that the payment data doesn’t go outside India. WhatsApp has established and confirmed the data center is now available in India. The central bank is auditing the transaction process and will give its final node once all the requirements are fulfilled by WhatsApp.

India is eagerly waiting for the WhatsApp Pay launch. WhatsApp has become the default messaging app in all smartphones in India.

There are existing players like Google Pay and Paytm who are currently dominating the digital payment market in India. With the launch of WhatsApp Pay, they are going to get the hit in their existing market share. WhatsApp is expected to become a leader in the digital payment market soon after its launch in India.

WhatsApp Pay UPI Platform – FAQs

The WhatsApp Pay runs on the UPI platform and Facebook’s existing infrastructure. It has obtained the necessary licenses from RBI to provide payments services in India

The UPI payment is considered to be the safest in India. For transferring money through UPI, the user doesn’t need to provide its bank account number or IFSC code like that is in NEFT/RTGS payments.

The UPI payment method is definitely safe and secure. End to end encryption secure verification methods, and much more. There are existing players like Google Pay and Paytm who are offering UPI payment service.

Right now there are Google Pay and Phone Pe are the two best UPI apps available in India. Let’s wait and watch for the WhatsApp Pay launch in India and see if it can prove to be the best UPI app in India.

Refer and earn is generally offered by the brands who want to establish their presence in the market and capture market share. WhatsApp is already an established brand in India. It is, in fact, the top brand and mobile app when it comes to the messaging app.

Secondly, WhatsApp currently doesn’t have any product or service except the messaging app. So they don’t have a marketing team like other companies have.

Third, the UPI payment platform doesn’t offer a commission to WhatsApp Pay for using its app to transfer money.

For Transferring money through WhatsApp Pay, you and your contact need to have UPI enabled bank account. The money transferred through WhatsApp Pay will directly go to the bank account. WhatsApp Pay doesn’t offer any mobile wallet like Paytm.

So in order to send money to your contact you first have to make sure that the person is having UPI enabled bank account.

No, you cannot transfer money outside India. UPI payment platform works within Indian bank networks only. It doesn’t allow foreign transactions.

WhatsApp doesn’t charge anything for transferring money through WhatsApp Pay. But you have to pay a nominal charge of Rs. 0.50 per transaction to your bank. These charges are taken and shared by NPCI and your bank.

Let me answer this question with the reverse question. What if the Indian government shares its data with private companies like JIO?

What if Banks share its data with apps like Paytm, Whatsapp, Phonepe, etc?

What if Google Pay is sharing its data with Google?

No payment data (secure or authentic data) is shared even with Whatsapp by banks in UPI transfers. Without getting that, Whatsapp will not be able to share it with Facebook.

Conclusion:

WhatsApp Pay is running on the UPI platform which is considered to be the best and secure payment platform in India. WhatsApp doesn’t store any payment data on its server so you don’t have to be worried about your data security.

Let WhatsApp Pay officially launched in India and use it at-least for peer-to-peer money transfer. I would say one should at-least test the feature as and when available. You can always delink your bank account in any UPI integrated payment app.

I hope the above information on the WhatsApp Pay UPI Platform is helpful. Please share it with your friends and family. Please subscribe to our blog for the latest updates and help on WhatsApp Pay.