Tired of waiting in a queue at your bank branch? Have you taken a leave from your job to complete the bank work? Feeling stuck up with your traditional baking? If the answers to these questions are “Yes” then now is the time to break the monotony. Don’t let your traditional banks taken you for granted for way too long. Here is the innovative, NiyoX Account.

Niyo is a digital-only saving account that offers saving account services no less than your traditional banks. You can open a saving account online and completely paperless. NiyoX has more than 1 million customers since its inception in the year 2015.

At the initial phase, the NiyoX had helped the salaried people to get the most out of the saving account. Niyo not only offers great service to its customers but also helpful while traveling abroad.

The Niyo team has experienced bankers, technology experts, and customer-centric staff.

With the NiyoX Saving account, you can pay bills, transfer funds, withdraw from ATM across the world, do online shopping. It also helps its account holder by giving meaningful insights on the spendings. So that you have a tab on where your money goes.

The bank provides loads of unique products and services that make Niyo stand out from the crowd. Let’s have a look at the product and services provided by NiyoX Saving Account.

- Instant Saving account opening.

- Saving + Wealth Account.

- Zero account maintenance charges.

- Up to 7% interest on saving account balance. (on the incremental amount of > 1 lakh.)

- Provides virtual debit card.

- Invest in mutual funds at no extra cost.

- State of an art mobile app.

- Highest military graded security.

- Deals and discount which helps you save more.

- Reward program.

- Insurance coverage up to ₹. 5 lacs. (Your money is safe in the Niyo).

Instant saving account opening.

With the latest technology at the backend, opening a saving account is like opening a Facebook account. You don’t have to visit any branch with a bunch of papers and wait for your turn to come. The new age of banking is just a click away. So what are you waiting for, just go on www.goniyo.com and get India’s best only digital saving account with loads of features.

Accessibility

NiyoX offers international debit card which is accepted across the globe. You can load your account in the Indian rupee and spend in any currency outside India. The real-time currency exchange features will auto-convert your rupee into the foreign currency. Not only this, the currency exchange markup is the lowest in the market so that you don’t have to shell out much on the fees and charges.

Saving+Wealth Account

NiyoX account is not just another bank account, it comes with a ready to use wealth account. You can easily start investing in mutual funds with the same bank account. You even don’t need to get your KYC done for investing in mutual funds.

Zero maintenance account

The saving account offers freedom from maintaining the minimum balance every month. There is no fee/charges levied to your bank account if your bank doesn’t have a minimum balance. So you can transact without any worry of running out of balance at the end of the month.

Higher Interest rate

The bank provides higher interest rates of up to 7% in the saving bank account. This is way high as compared to the traditional banks who are providing merely 3% to 4% on the account balance.

Virtual Debit Card

The bank offers a virtual debit card to all the account holders at no cost. With the help of this card, you can do online transactions for shopping, ticket booking, and much more.

Wealth Account

The NiyoX account is not a regular bank account, it also helps you to invest in mutual funds and create wealth in the long run. As an account holder, you can start investing in mutual funds instantaneously. There is no need to get a separate KYC (Know Your Customer) for investing in mutual funds.

Mobile App

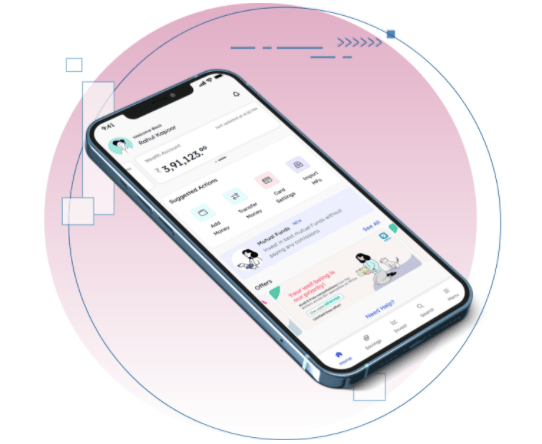

With state of an art mobile app, you can transact seamlessly with your fingers. You don’t have to visit anywhere for your banking needs. The mobile app comes with the latest technology and bank graded security features like PIN and fingerprint access. This makes the mobile app secure and sturdy.

Reward program

Spending is rewarding! Yes with the Niyo bank, you can earn reward points on every penny you spend. There is a reward program specially designed for the young Millenials to get an extra buck.

NiyoX Mobile App

The NiyoX mobile app lets you do more than what you can expect from the mobile banking app. The feature-rich mobile app not only do banking, but you can invest in the mutual fund from the same app and with the same bank account at no extra cost. With the mobile app, you can lock the debit card if you lost it or don’t want to use it for some time.

NiyoX Account vs Traditional Bank Account

Let’s have a look as to why NiyoX is better than the traditional banks in India.

| NiyoX Account | Traditional Bank Account |

|---|---|

| Offers Instant account opening | Account opening takes time and efforts |

| Higher interest rate | Lower interest rates |

| Saving+Wealth = Dual account | Needs to open a separate account |

| Zero maintenance account | Requires minimum balance |

| World wide accessibility | Limited accessibility |

Why you should have Niyo Equitas Saving Account?

The NiyoX account is a new age account for the millennials in India. It offers much more than the traditional bank account. The new India believes in speed and faster access.

The Niyo mobile app provides both in a bundle. And how about getting a little extra interest on the balance of your account? Who would not love to have extra interest that your bank account will fetch for you without any efforts?

Plus all the above-mentioned benefits make Niyo a choice of millions in India.

NiyoX – Bank for Millenials

As people have become more tech-savvy and are comfortable doing things for themselves on the computer and mobile, a saving bank account like Niyo would help them manage their finances much more easily and effectively.

The younger generation actually doesn’t want to deal with a staff member, rather they want to do things themselves. And they want to do it NOW – at a time convenient for them. They don’t want to wait. They don’t want to wait for 2 days for a payment to reach another person. They believe in instant gratification.

Why can’t it be done now? Why I have to wait for 2 days? Why I have to call up the call center? The younger breed wants to get things done instantly.

NiyoX Account – FAQs

It is completely safe to open a savings account with Niyo. They have a collaboration with the IDFC first bank (small finance bank). All the RBI banking guidelines are applicable to Niyo. So you can rest assured about its authenticity.

There is a simple process of getting a Niyo account.

1. KYC

2. Personal Information

3. Account Creation

The account opening process is completely paperless. However, you need to have your PAN and Aadhaar number handy during the account opening process.

No, the account can be opened in a single name only.

Yes, you can add one nominee for your account.