Citibank is a leading US bank operating in India. It is one of the premium banks in India. On 15th April 2021, the bank has announced that they will exit from the Indian retail business by selling their stake and customer base. The bank will continue with its wealth management and institutional business in India. In this article, we will discuss the impact of the Citibank exit from India on the other stocks which may benefit from Citibank’s exit.

How Big Citibank in India?

Citibank has started its Indian operation in 1902 and currently serving 2.9 million retail customers with 1.2 million bank accounts. It has 2.2 million credit card accounts in India comprises 6% of the credit card market in India. Citibank has 35 branches across India as of March 2020. Last year the bank has reported a net profit of Rs. 4918 crore.

Citibank Exit India – Which Share Will Go Up?

As stated by Citibank that they will exit from the consumer retail business. What is this consumer business? The consumer is you and me who are using the products of Citibank. Below are the 3 stocks that will be benefited from Citibank exit India.

Credit Card business

Citibank in India is majorly in the credit card business. It is offering a premium credit card range in India with very stringent criteria for applying. As mentioned above, Citibank’s credit card market share is 6%. In numbers, it will be 2.2 million credit cards in India. If Citibank is closing its credit card business then these customers will be migrated to another company. Now you must be thinking which is this another company?

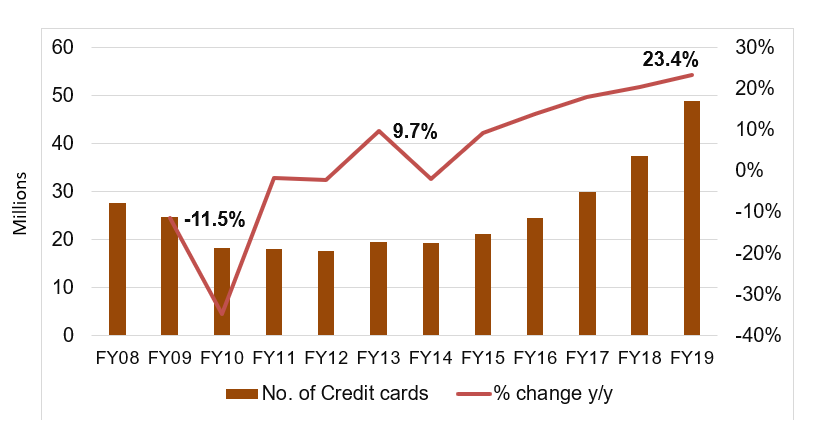

So, first let’s check the credit card market in India.

The above image says that the credit card penetration in India is as low as 4%. While if you check other countries, it is quite high. This means, there is a huge scope for the credit card industry in India.

The credit card industry in India is growing at the speed of 23%. This is a huge growth rate for any industry.

Currently, the SBI credit card is the biggest player in the credit card industry in India. So if Citibank shuts its credit card business, we can anticipate the most of the customers may shift to SBI credit cards. Recently the mutual fund and FII has increased their stake in SBI credit card. This is a signal that SBI credit card stock has the potential to give multifold returns in the coming years.

If we assume that 50% of Citibank’s credit card business will go to SBI credit cards, the numbers will be around 1.1 million customers. On 16th April 2021, the SBI credit card stock has rallied 7% even before any official announcement has taken place. Hence for the long term, the SBI credit card is a good stock for investment.

Retail Banking Business

The second main retail business of Citibank is the retail banking business. The main leading retail bank in India is HDFC bank. HDFC Bank is a leading private sector bank in India and it is very aggressive in its business. The bank has given good returns year-on-year and the stock price has been increasing rapidly.

If we assume that half of Citibank’s retail banking customers will go to HDFC bank, the numbers will be around 60000 accounts. HDFC Bank is providing a new-age banking experience that will suit Citibank’s customers.

There are other private sector banks like ICICI Bank, Axis Bank which can compete with HDFC Bank in the retail banking segment. But looking at the size and product portfolio, HDFC bank is the leading bank in the retail banking segment.

Housing Loan Business

The third and the last segment which will get affected by Citibank’s India Exit is the retail housing loan business. Citibank is offering a home loan at a very attractive and competitive rate as compared to other banks. Citi offers a range of affordable home loan products. With that said, fixed-rate home loans typically stand out the most. This is because the bank offers some of the best fixed rates for home loans in India.

Which is the leading company in housing loan finance in India? The answer is Housing Development Finance Corporation Ltd. It is a leading home loan provider in India. One of the top 5 companies in the Nifty 50 index. The company has a healthy loan book with the least bad debt in the home loan segment.

Conclusion:

Citibank India’s exit will benefit the above three companies in the coming years. Keep track of these three companies and invest in these companies for high returns on your investment. These are my personal views, you may consult the expert advisor before making any purchase decision.